Demystifying Economic Metrics: The Consumer Price Index (CPI) Insight

Understanding economic indicators is crucial for navigating the complexities of a nation’s financial landscape. Among these indicators, the Consumer Price Index (CPI) holds a special place, serving as a key metric for assessing inflation and its impact on consumer purchasing power. This article unravels the layers of the CPI, shedding light on its intricacies and significance in economic analysis.

Defining the Consumer Price Index (CPI)

The Consumer Price Index is a vital economic metric that measures the average change in prices paid by consumers for goods and services over time. This comprehensive index is crafted from a basket of commonly purchased items, representing the spending habits of the average consumer. As prices fluctuate, the CPI provides valuable insights into inflationary trends, guiding economic decisions.

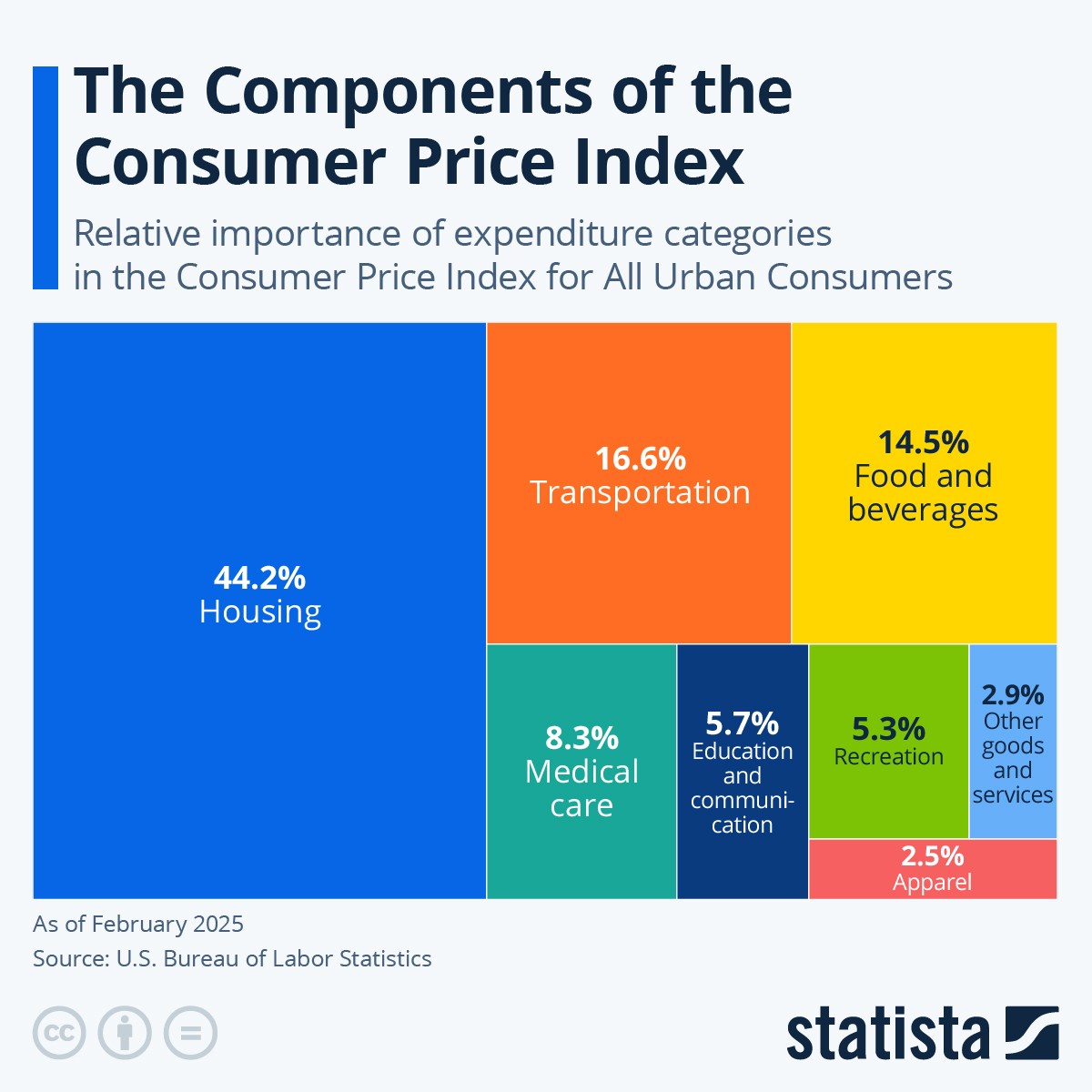

Components of the CPI Basket: A Microcosm of Consumption

At the heart of the Consumer Price Index is the carefully curated CPI basket. This basket encompasses a diverse range of goods and services, reflecting the myriad expenditures of consumers. From housing and food to transportation and healthcare, each component is assigned a weight based on its relative importance in the average consumer’s budget. The dynamic nature of this basket mirrors the evolving consumer landscape.

The CPI Calculation: Unveiling the Inflation Rate

Understanding the CPI involves delving into its calculation methodology. By comparing the current index level to a base period index, economists derive the percentage change, unveiling the inflation rate. This rate serves as a crucial indicator, influencing monetary policies, interest rates, and strategic economic interventions. Policymakers rely on CPI data to make informed decisions about steering the economy.

Consumer Price Index and Purchasing Power Dynamics

One of the fundamental impacts of the Consumer Price Index is on consumer purchasing power. As the index reflects changes in prices, it directly influences how far a consumer’s money can stretch. Understanding these dynamics is essential for individuals and businesses alike, shaping spending habits, budgeting decisions, and overall financial planning.

CPI Trends and Economic Health Assessment

Economists scrutinize CPI trends to assess the overall health of an economy. The direction of the Consumer Price Index provides valuable insights into inflationary pressures. A rising CPI may indicate increasing prices and potential overheating, prompting adjustments in monetary policies to maintain economic stability. Conversely, a declining CPI may trigger measures to stimulate economic activity.

Consumer Price Index and Policy Impact

The Federal Reserve closely monitors the Consumer Price Index as part of its dual mandate to achieve stable prices and maximum employment. The CPI influences the formulation of monetary policy, guiding decisions on interest rates. A high CPI may lead to rate hikes to curb inflation, while a low CPI might prompt rate cuts to stimulate economic growth. The delicate balance reflects the intricate dance between CPI data and policy adjustments.

CPI’s Role in Cost-of-Living Adjustments

The Consumer Price Index is not just an economic metric; it plays a tangible role in the lives of individuals through cost-of-living adjustments (COLAs). Various financial instruments, such as Social Security benefits and pension payments, incorporate CPI data. COLAs ensure that these payments keep pace with the rising cost of living, providing a crucial financial safety net for many.

Limitations and Criticisms of the CPI

While the CPI is a powerful economic tool, it is not without criticisms. Some argue that it may not fully capture changes in the quality of goods or adequately account for the substitution effect. These limitations spark ongoing discussions among economists and statisticians about refining the CPI calculation to enhance accuracy and relevance.

Investment Strategies and the CPI

Investors keenly analyze CPI data to inform their strategies. Understanding inflation trends is pivotal for making informed investment decisions. Certain investment vehicles, such as Treasury Inflation-Protected Securities (TIPS), are explicitly designed to hedge against inflation. Investors adjust their portfolios based on CPI expectations to safeguard against erosion of purchasing power.

The Evolution of the Consumer Price Index

As technology advances and consumer habits evolve, the Consumer Price Index undergoes adaptations to stay reflective of contemporary realities. Incorporating online prices, accounting for changes in shopping patterns, and adjusting for quality improvements are ongoing efforts to ensure the CPI remains a relevant and accurate economic indicator.

Navigating Economic Realities with the CPI

In conclusion, the Consumer Price Index is a linchpin in economic analysis, offering insights into inflation, policy decisions, and the dynamics of consumer purchasing power. Navigating economic realities requires a nuanced understanding of the CPI and its far-reaching impact. Explore more about the Consumer Price Index at dearakana.my.id for a comprehensive insight into this cornerstone of economic measurement.