Family Financial Wellness: Mastering Smart Budgeting Strategies

Managing a family budget effectively is key to achieving financial wellness. In this article, we delve into practical strategies and tips for families to master smart budgeting, ensuring financial stability and achieving long-term goals.

Understanding Family Financial Goals

The foundation of effective family budgeting lies in understanding and defining financial goals. Whether it’s saving for education, planning for a home, or creating an emergency fund, clear goals provide direction for budgeting decisions. Take time as a family to discuss and prioritize these goals, aligning them with your vision for the future.

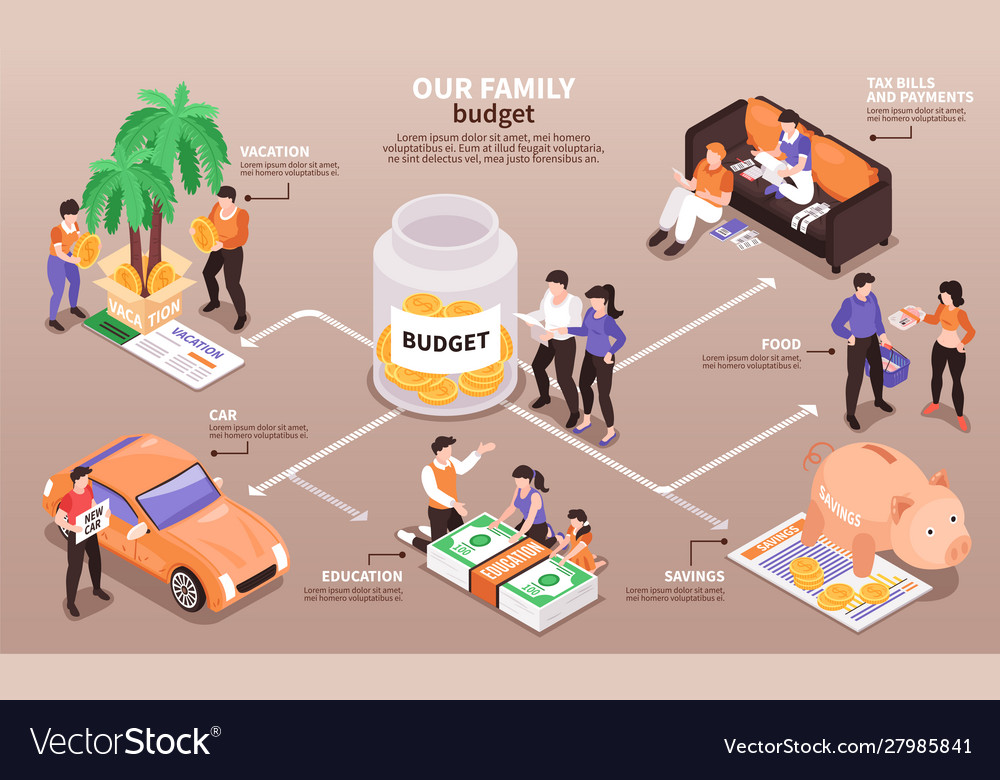

Creating a Comprehensive Family Budget

A comprehensive family budget includes income, expenses, and savings. Categorize expenses into needs and wants, distinguishing between essential items like housing, utilities, and groceries, and discretionary spending on non-essential items. Allocate a portion of the income to each category, ensuring that all aspects of family life are covered.

Prioritizing Essential Expenses

Prioritizing essential expenses ensures that the family’s basic needs are met before discretionary spending. This includes housing, utilities, groceries, and healthcare. By establishing a hierarchy of needs, families can ensure that the most critical aspects of their well-being are covered, providing a sense of financial security.

Building an Emergency Fund

An emergency fund is a financial safety net that every family should prioritize. Aim to save three to six months’ worth of living expenses to cover unforeseen circumstances such as medical emergencies, car repairs, or job loss. An emergency fund prevents these unexpected events from derailing your family budget.

Strategic Debt Management

For families carrying debt, strategic debt management is crucial. Prioritize paying off high-interest debts first, such as credit cards or loans with substantial interest rates. Implement a debt repayment plan aligned with your budget, gradually reducing outstanding balances and freeing up resources for other financial goals.

Budgeting for Education and Future Expenses

If your family has education expenses or other significant future financial goals, allocate a specific portion of your budget to these objectives. Establishing dedicated funds for education, home buying, or retirement ensures that you are consistently working toward these long-term aspirations.

Utilizing Budgeting Tools and Apps

In the digital age, numerous budgeting tools and apps are available to help families manage their finances more efficiently. Consider using apps that allow you to track expenses, set budget goals, and receive real-time insights into your financial health. Embracing technology can simplify the budgeting process.

Regularly Reviewing and Adjusting the Budget

A family budget is not static; it requires regular review and adjustment. Schedule regular budget meetings to assess your financial situation, track progress toward goals, and make necessary adjustments. Life circumstances change, and a flexible budget ensures that your financial plan remains realistic and achievable.

Incorporating Family Financial Education

Financial literacy is a valuable skill for every family member. Incorporate financial education into your family routine, teaching children about budgeting, saving, and making informed financial decisions. Fostering a culture of financial awareness empowers the entire family to contribute to the success of the budget.

Celebrating Financial Milestones

As your family progresses toward its financial goals, take the time to celebrate milestones. Whether it’s paying off a significant debt, reaching a savings target, or achieving a long-term financial goal, acknowledging these milestones reinforces positive financial habits and motivates the family to stay on track.

Budgeting for Families: A Lifelong Journey

In conclusion, mastering smart budgeting strategies is a lifelong journey that contributes to the financial wellness of your family. By understanding your financial goals, creating a comprehensive budget, prioritizing essential expenses, and embracing financial education, your family can navigate the complexities of budgeting with confidence. Explore more about Budgeting for Families at dearakana.my.id, where personalized strategies and resources are available to support your family’s financial journey.