Mitigating Economic Inflation: Impact and Strategies

In the ever-evolving landscape of economic dynamics, the impact of inflation is a pervasive force that influences individuals, businesses, and governments alike. Understanding the multifaceted repercussions and implementing effective strategies for mitigation is essential for navigating the challenges posed by economic inflation.

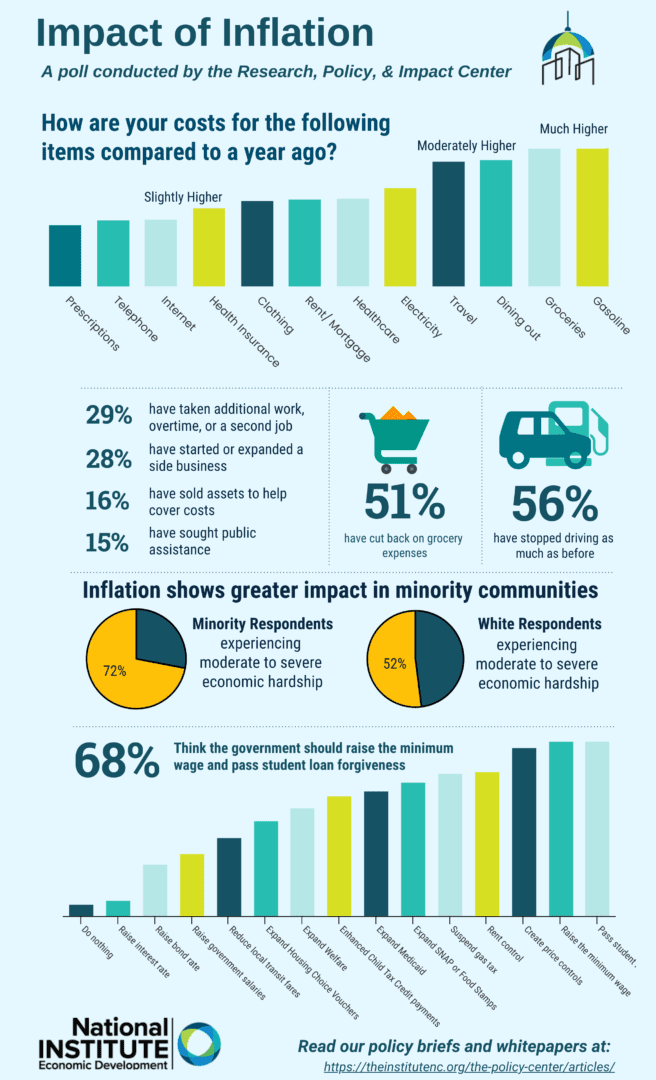

The Far-Reaching Impact on Consumer Power

Economic inflation directly affects consumers by eroding their purchasing power. As the general price level rises, the real value of money decreases, impacting the ability of individuals to maintain their standard of living. This shift necessitates a recalibration of spending habits and financial planning to adapt to the changing economic landscape.

Challenges Faced by Businesses: Balancing Act

For businesses, economic inflation presents a delicate balancing act. The increased cost of production, influenced by rising prices of raw materials and labor, squeezes profit margins. Yet, passing on these increased costs to consumers can be challenging, requiring strategic financial management to maintain competitiveness and viability in the market.

Navigating Investments in an Inflationary Environment

Investors grapple with the impact of inflation on their portfolios. Fixed-income investments may struggle to outpace inflation, leading to a gradual erosion of the real value of savings. Diversifying investment portfolios, exploring inflation-protected securities, and opting for assets historically resilient to inflation are strategies to navigate the complexities of an inflationary environment.

Real Estate Dynamics: Appreciation and Challenges

The real estate sector experiences a dual impact during periods of economic inflation. While property values may appreciate, the increased costs of construction and financing present challenges for both buyers and developers. Understanding the nuanced dynamics of the real estate market becomes crucial for making informed investment decisions.

Government Policies: Navigating Economic Stability

Governments play a pivotal role in mitigating the impact of economic inflation. Through monetary policies, interest rate adjustments, and fiscal measures, governments aim to maintain economic stability. Analyzing and understanding these policies becomes imperative for businesses and individuals navigating the complex landscape of an inflationary environment.

Individual Strategies: Building Financial Resilience

Individuals can adopt various strategies to mitigate the impact of economic inflation. Investing in assets that traditionally perform well during inflationary periods, diversifying income sources, and staying informed about market trends are essential for building financial resilience. Adjusting spending habits in line with changing economic conditions also contributes to individual financial stability.

Business Adaptability: Innovation Amid Challenges

Successful businesses in an inflationary environment are those that can adapt and innovate. This involves reevaluating supply chains, optimizing operational efficiency, and exploring new revenue streams. The ability to pivot and evolve becomes a key determinant of business success in the face of economic challenges.

International Trade Dynamics: Exchange Rate Impacts

Economic inflation doesn’t operate in isolation; it has implications for international trade dynamics. Fluctuations in exchange rates based on inflation differentials between countries impact the competitiveness of exports and imports. Businesses engaged in international trade must factor these dynamics into their strategies for sustained success.

Strategies for Building Economic Resilience

In the wake of economic inflation, building resilience becomes a collective endeavor. Diversified investments, strategic financial planning, and adaptability to market changes are essential components of resilience. Governments, businesses, and individuals alike contribute to shaping an economically resilient future.

Mitigating Economic Inflation: A Call to Action

Understanding the impact of economic inflation and implementing effective strategies is not merely an academic exercise; it’s a call to action. It prompts individuals to make informed financial decisions, businesses to innovate, and governments to enact policies that foster economic stability. Navigating these challenges collectively can lead to a more resilient and sustainable economic landscape.

To delve deeper into the nuances of mitigating Economic Inflation Impact and implementing effective strategies, visit Economic Inflation Impact. Explore insights, expert opinions, and practical tips for navigating the complexities of economic inflation.