Introduction:

Understanding and monitoring the Inflation Outlook in the United States is paramount for businesses, investors, and individuals alike. In this article, we’ll explore the various factors influencing the inflation landscape in the US and its broader implications.

Factors Driving US Inflation:

The Inflation Outlook in the US is shaped by a combination of factors. Key among them are supply chain disruptions, changes in consumer behavior, and the impact of fiscal and monetary policies. As we navigate these factors, it becomes essential to grasp their individual and collective contributions to inflation.

Monetary Policy and the Federal Reserve:

One of the significant influencers of the US Inflation Outlook is the monetary policy implemented by the Federal Reserve. Interest rate decisions and measures taken to control the money supply play a pivotal role in managing inflation. Analyzing the Fed’s stance provides insights into the direction of inflation and potential market reactions.

Consumer Behavior and Spending Habits:

Understanding how consumers behave and spend is integral to predicting inflation trends. Changes in consumer sentiment, income levels, and spending patterns can have a cascading effect on the demand for goods and services. Examining these behavioral aspects provides valuable indicators for forecasting inflation.

Supply Chain Challenges:

The resilience of the supply chain is a critical factor affecting inflation. Disruptions in the supply chain, whether due to global events, transportation issues, or shortages in key materials, can lead to increased costs of production. These increased costs often translate into higher prices for end consumers.

Impact on Investments and Asset Classes:

The Inflation Outlook has a direct impact on various investments and asset classes. Investors must consider how inflation erodes purchasing power over time and adjust their portfolios accordingly. Certain assets, like real estate and commodities, are often considered hedges against inflation.

Government Policies and Fiscal Measures:

The fiscal policies enacted by the US government also contribute to the Inflation Outlook. Government spending, taxation, and stimulus measures can influence economic activity and, subsequently, inflation. An analysis of these policies provides a comprehensive view of the economic landscape.

Employment and Wage Dynamics:

Employment trends and wage dynamics are closely tied to inflation. Wage growth can contribute to increased consumer spending, driving up demand for goods and services. Conversely, high unemployment rates may result in reduced demand and deflationary pressures.

Global Economic Interconnectedness:

Given the globalized nature of economies, global economic conditions impact the US Inflation Outlook. Factors such as international trade dynamics, geopolitical events, and commodity prices can have far-reaching effects. Understanding these global connections is essential for a comprehensive view of inflation trends.

Consumer Price Index (CPI) as an Indicator:

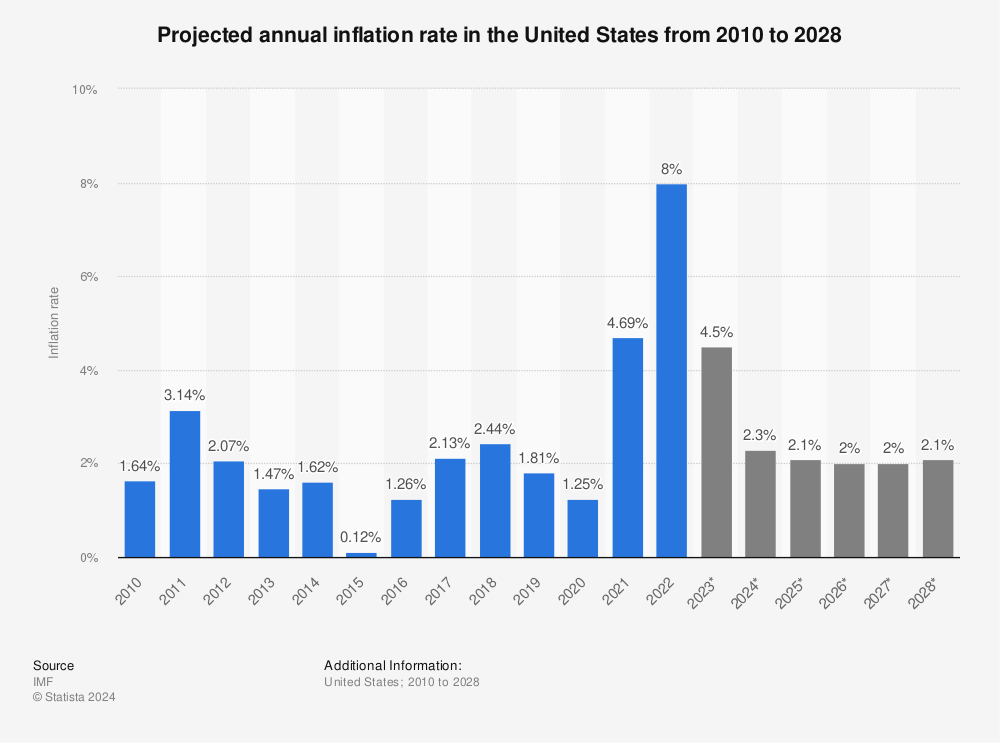

The Consumer Price Index (CPI) serves as a key indicator for measuring inflation. It tracks the average change in prices paid by consumers for a basket of goods and services. Analyzing CPI data provides a quantitative perspective on inflation trends, helping policymakers and businesses make informed decisions.

Conclusion and Further Resources:

As we navigate the complex landscape of the Inflation Outlook in the United States, staying informed is crucial. To delve deeper into the subject and access valuable resources, explore Inflation Outlook US. Being aware of economic indicators, policy changes, and global developments empowers individuals and businesses to make sound financial decisions in an ever-evolving economic environment.