Mastering Financial Success: Effective Money Management Strategies

Navigating the complex world of personal finance requires intentional and strategic money management. In this guide, we explore key strategies to help you achieve financial success and build a secure future.

Assessing Your Financial Situation

Begin your journey to financial success by assessing your current financial situation. Take stock of your income, expenses, assets, and debts. Understanding your financial landscape provides a foundation for crafting effective money management strategies tailored to your specific needs and goals.

Creating a Realistic Budget

A well-crafted budget is a fundamental tool in money management. Outline your monthly income and allocate funds to essential expenses, savings, and discretionary spending. A realistic budget serves as a roadmap, helping you stay on track and prioritize your financial objectives.

Building an Emergency Fund

Establishing an emergency fund is a crucial step in financial planning. Aim to save three to six months’ worth of living expenses. This fund acts as a financial safety net, providing peace of mind and protection against unexpected expenses or income disruptions.

Managing and Eliminating Debt

Effectively managing and eliminating debt is integral to financial success. Prioritize high-interest debts and develop a repayment plan. Consider debt consolidation strategies to streamline payments. Over time, reducing and eliminating debt contributes to improved financial health.

Investing for Long-Term Growth

Investing is a powerful tool for building wealth over time. Develop a diversified investment portfolio aligned with your risk tolerance and financial goals. Explore investment options such as stocks, bonds, mutual funds, and real estate. Regularly review and adjust your investment strategy based on market conditions and life changes.

Saving for Retirement

Saving for retirement is a long-term financial goal that requires early planning. Contribute to retirement accounts such as 401(k)s or IRAs. Leverage employer-sponsored retirement plans and take advantage of employer matching contributions. Consistent contributions and strategic investment choices can help you achieve a comfortable retirement.

Prioritizing Financial Goals

Define and prioritize your financial goals. Whether it’s homeownership, education, or travel, allocate resources based on your most significant objectives. Prioritizing allows you to allocate funds efficiently and work towards achieving your goals systematically.

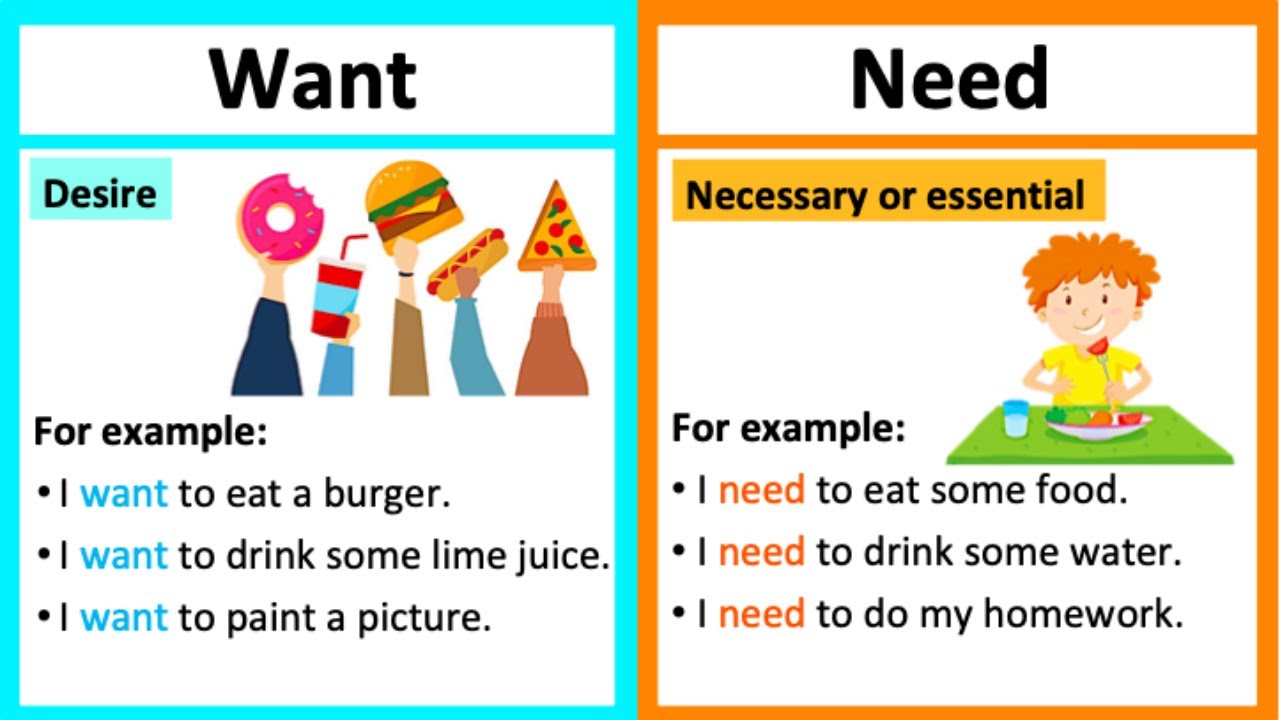

Implementing Smart Spending Habits

Cultivate smart spending habits to maximize your financial resources. Differentiate between needs and wants, practice mindful spending, and look for ways to cut unnecessary expenses. Adopting a frugal mindset enables you to allocate more funds towards savings and investments.

Regularly Reviewing and Adjusting Strategies

Financial success is an ongoing journey that requires regular evaluation and adjustment. Periodically review your financial strategies, reassess your goals, and adjust your plan based on changes in your life, income, or economic conditions. Flexibility and adaptability are key to long-term financial well-being.

Educating Yourself About Personal Finance

Empower yourself with knowledge about personal finance. Stay informed about financial trends, investment opportunities, and changes in tax laws. Continuous education allows you to make informed decisions, take advantage of financial opportunities, and navigate economic challenges.

Exploring Money Management Strategies

For additional insights and resources on effective money management strategies, visit Money Management Strategies. Empowering yourself with financial knowledge and implementing strategic money management practices set the stage for a secure and prosperous financial future.

In conclusion, mastering financial success through effective money management involves a combination of budgeting, saving, investing, and continuous education. By adopting these strategies and remaining vigilant in your financial approach, you can achieve your goals, build wealth, and secure a brighter future.