Money Smarts for Kids: Nurturing Financial Education Early

In a world where financial literacy is increasingly crucial, instilling money smarts in children becomes a responsibility. This article explores the significance of financial education for kids, offering insights into its importance and practical strategies for implementation.

The Foundation of Financial Literacy in Childhood

The importance of financial education for kids cannot be overstated. Early exposure to financial concepts lays the groundwork for a lifetime of informed decision-making. Teaching children about money, budgeting, and saving from a young age helps cultivate a healthy and responsible relationship with finances.

Interactive Learning: Making Finance Fun for Kids

Traditional methods of financial education may not resonate with young minds. Incorporating interactive and engaging activities can make learning about money enjoyable for kids. Board games, interactive apps, and simulations are effective tools to introduce financial concepts in a playful manner.

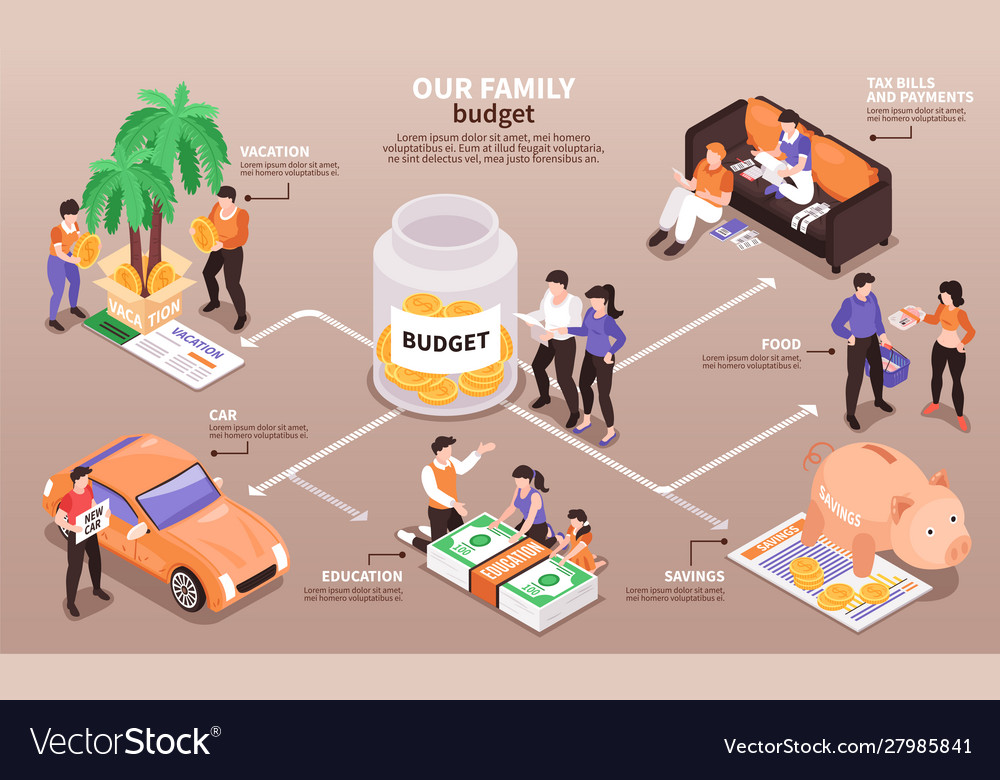

Setting the Basics: Budgeting and Saving

Financial education for kids should begin with the basics of budgeting and saving. Teaching children to allocate money for different purposes, set savings goals, and distinguish between needs and wants provides a practical foundation for responsible financial habits.

Earning and Spending: Introducing the Concept of Income

Introducing the concept of earning money helps kids understand the connection between work and income. Whether through allowances, chores, or simple entrepreneurial ventures, kids can learn the value of money earned through effort. Balancing earning with responsible spending choices completes this crucial financial lesson.

Needs vs. Wants: Cultivating Financial Discernment

Teaching kids to differentiate between needs and wants is a fundamental aspect of financial education. Understanding that some expenses are essential for daily living while others are optional develops a sense of financial discernment that will serve them well in adulthood.

Banking Basics: The Role of Banks and Savings Accounts

Introducing kids to banking concepts at an early age helps demystify financial institutions. Explaining the role of banks, the purpose of savings accounts, and the concept of interest lays the groundwork for more advanced financial understanding as they grow older.

Goal Setting: Fostering a Savings Mindset

Encouraging kids to set financial goals, whether for a coveted toy or a long-term savings plan, instills a savings mindset. This practice not only teaches delayed gratification but also introduces the concept of financial planning and goal-oriented behavior.

Teaching Smart Spending: Money Management in Daily Life

Financial education for kids should encompass practical money management skills. Teaching them how to make wise spending choices, comparison shopping, and understanding the value of purchases helps develop essential financial capabilities.

Real-life Simulations: Preparing Kids for Financial Decisions

Simulating real-life financial scenarios provides valuable experiential learning. Activities like setting up a mini-store, role-playing as consumers, and making simulated financial decisions enhance practical financial skills and prepare kids for real-world money situations.

Parental Involvement: Fostering a Healthy Financial Environment

Parents play a crucial role in nurturing financial education for kids. Open conversations about money, involving kids in family budgeting discussions, and serving as positive financial role models create a healthy financial environment that supports ongoing learning.

Explore more about Financial Education for Kids here.

In conclusion, fostering money smarts in kids through financial education is an investment in their future financial well-being. By making learning interactive, introducing essential concepts early on, and involving parents in the process, we can empower the next generation with the financial knowledge they need to navigate the complexities of the modern economy.