Navigating U.S. Monetary Policy Landscape

The United States monetary policy plays a pivotal role in shaping the nation’s economic environment. From interest rates to inflation targets, various factors influence the decisions made by the Federal Reserve. This article delves into the intricacies of U.S. monetary policy, exploring its components, impact, and the challenges faced in steering the nation’s economic course.

The Federal Reserve: Guardian of Monetary Stability

At the core of U.S. monetary policy is the Federal Reserve, often referred to as the Fed. Established in 1913, the Fed is the central banking system responsible for formulating and implementing monetary policies. Its primary objectives include promoting maximum employment, stable prices, and moderate long-term interest rates.

Interest Rates: Balancing Act for Economic Growth

One of the most powerful tools in the Fed’s toolkit is the manipulation of interest rates. Adjusting the federal funds rate influences borrowing costs, spending, and investment throughout the economy. Lowering rates can stimulate economic activity, while raising them is used to cool down an overheating economy and manage inflation.

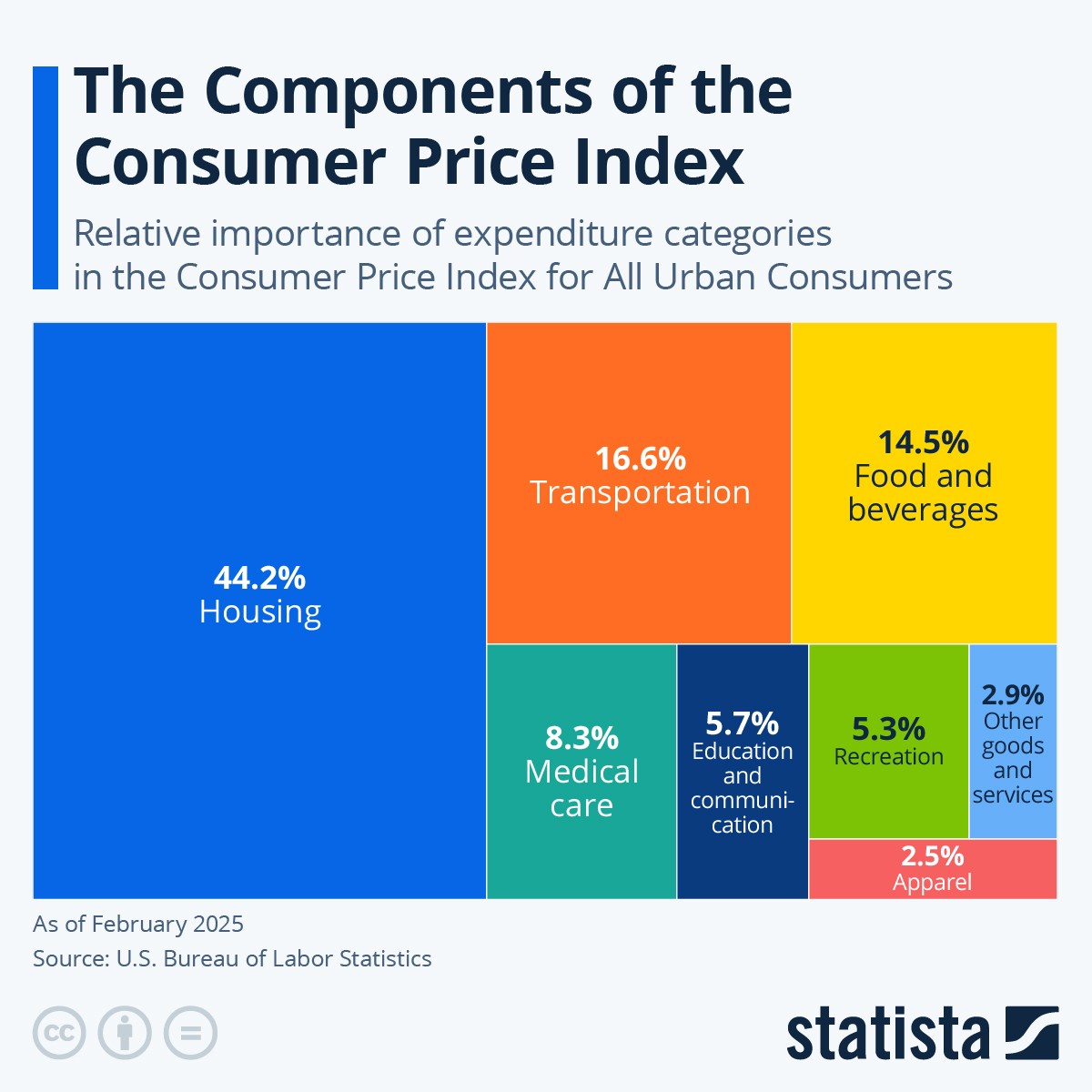

Inflation Targeting: Striving for Price Stability

Maintaining stable prices is a key pillar of U.S. monetary policy. The Fed has a dual mandate of fostering maximum employment and achieving an inflation rate of around 2%. Inflation targeting is a delicate balance, aiming to avoid both deflationary pressures and excessive inflation that could erode the purchasing power of the currency.

Quantitative Easing: Unconventional Monetary Measures

During times of economic stress, the Federal Reserve may resort to unconventional measures such as quantitative easing (QE). This involves purchasing financial assets like government bonds to inject liquidity into the financial system. QE is a tool employed to lower long-term interest rates and stimulate economic growth.

Challenges in Unprecedented Times

The U.S. monetary policy landscape has faced unprecedented challenges, particularly in the aftermath of the 2008 financial crisis and the recent global health crisis. Navigating through economic downturns while avoiding deflationary spirals and supporting recovery poses intricate challenges for the Fed.

Global Implications: U.S. Dollar as the World’s Reserve Currency

The U.S. dollar’s status as the world’s primary reserve currency amplifies the global implications of U.S. monetary policy. Changes in interest rates or monetary measures can impact international capital flows, exchange rates, and the economic stability of nations relying on the dollar for trade and reserves.

Financial Markets’ Reaction: A Barometer of Sentiment

Financial markets closely watch and react to every nuance of U.S. monetary policy. Interest rate decisions, statements from Federal Reserve officials, and economic indicators serve as barometers of market sentiment. The interconnectedness between monetary policy and financial markets highlights the importance of clear communication from the Fed.

Digital Transformation: Exploring Central Bank Digital Currency (CBDC)

The digital transformation is shaping discussions around the potential issuance of a central bank digital currency (CBDC) by the Federal Reserve. Exploring the implications, challenges, and benefits of a CBDC is on the agenda, as central banks globally assess the role of digital currencies in the future of monetary systems.

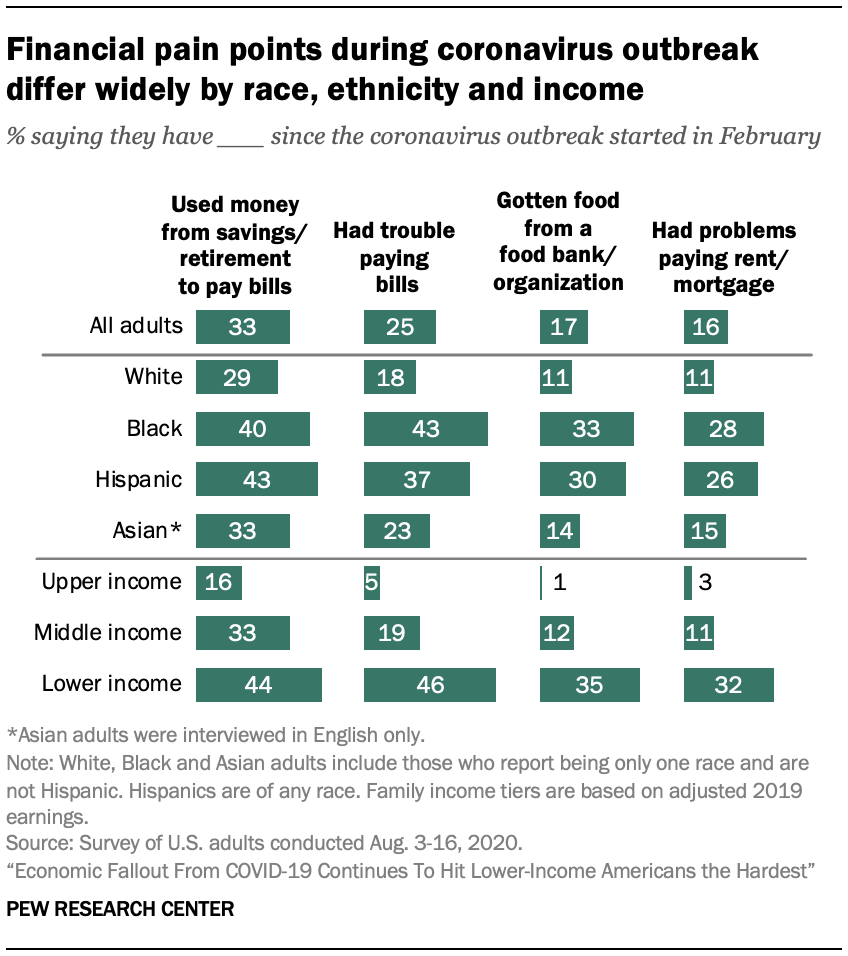

Inclusive Monetary Policy: Addressing Economic Disparities

Recent discussions within the Federal Reserve emphasize the importance of inclusive monetary policy. Acknowledging and addressing economic disparities, particularly in areas such as employment and access to financial services, is becoming a focal point. Crafting policies that foster broad-based economic prosperity is a key consideration.

U.S. Monetary Policy in Transition: Adapting to New Realities

As the United States navigates evolving economic landscapes, the Federal Reserve continually adapts its monetary policy strategies. Navigating through uncertainties, embracing innovation, and addressing societal challenges are integral to shaping a monetary policy that fosters sustainable economic growth and stability.

Explore Insights on U.S. Monetary Policy at Dearakana

For in-depth analyses, updates, and insights into U.S. monetary policy, visit United States Monetary. This platform serves as a valuable resource for individuals, businesses, and policymakers seeking a deeper understanding of the dynamics, decisions, and implications of U.S. monetary policy.

Conclusion: Guiding the Economic Course

In conclusion, navigating the U.S. monetary policy landscape requires a nuanced understanding of its components and the challenges inherent in steering a complex economy. The Federal Reserve’s decisions ripple through financial markets, influence global economic dynamics, and shape the economic well-being of individuals and businesses. As the U.S. economy evolves, the adaptability and effectiveness of monetary policy will remain pivotal in guiding the nation’s economic course.